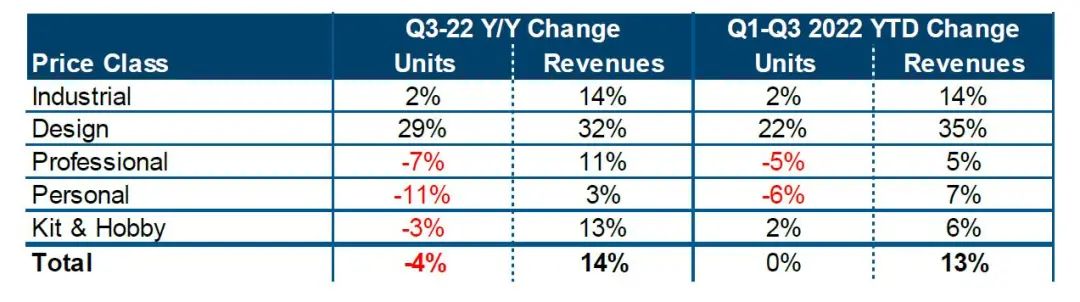

On January 10, 2023, the data released recently by CONTEXT, a 3D printing research institute, showed that in the third quarter of 2022, the total volume of global 3D printer shipments fell by 4%, while the system (equipment) sales revenue increased by 14% during this period.

Chris Connery, director of global analysis at CONTEXT, said: “Although the shipment volume of 3D printers at different price levels varies greatly, the system revenue has increased compared with a year ago.”

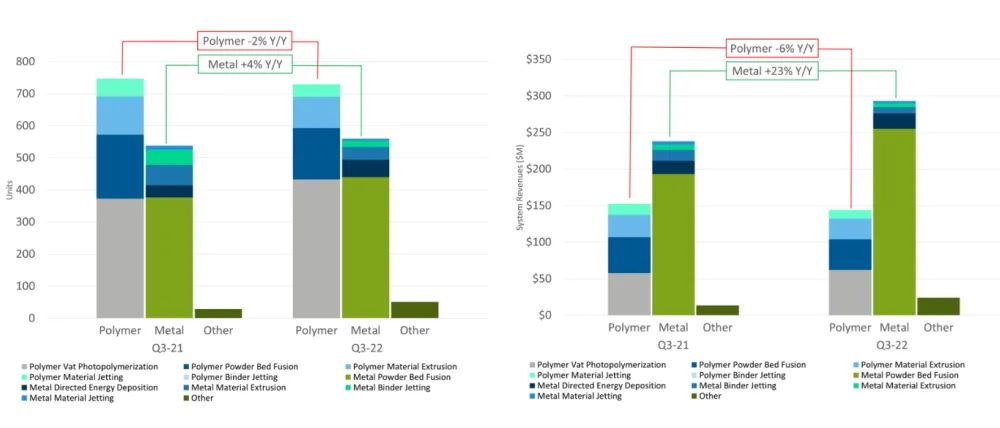

The report shows that the shipment volume of industrial 3D printers increased by only 2%, of which metal 3D printers increased by 4% and industrial polymer 3D printers decreased by 2%. Due to the joint influence of demand and supply chain, the shipments of professional, personal, kit and hobby classes decreased by – 7%, – 11% and – 3% year on year. Therefore, the growth of 3D printing industry in this quarter is more related to revenue than the growth of shipment.

The global inflationary pressure led to the rise of equipment prices at all levels, thus supporting the growth of income. Industrial-grade metal manufacturers also benefited from the shift in demand for more efficient and productive machines again and promoted the increase of industry income. For example, metal powder bed melting equipment has more lasers and higher efficiency, which can achieve higher output.

△ Global 3D printer system shipments and income changes (divided into industrial, design, professional, personal, suite and personal hobbies according to price grade). Comparison between the third quarter of 2022 and the third quarter of 2021; Compare the third quarter of 2022 with the first quarter.

Industrial equipment

In the third quarter of 2022, the characteristics of industrial equipment shipments:

(1) The strong growth of metal directed energy deposition system is partly due to the emergence of the new low-end manufacturer Meltio;

(2) The demand for metal powder bed melting system continues to rise, especially in China.

During this period, China was not only the world’s largest market (35% of the world’s industrial 3D printers were shipped in China), but also saw higher growth (+34%), higher than North America or Western Europe.

Chris Connery pointed out: “Many well-known 3D printer companies have made layoffs because the industry dynamics are different from the situation at the beginning of the year. Some companies are facing challenges in the supply chain, which hinders their ability to deliver more equipment, while others are affected by stagnant demand.”

In the fear of the coming economic recession, some end markets are reducing capital expenditure as a precautionary measure until the global macroeconomic situation stabilizes.

German EOS, the leader of the industrial market, has the highest system (equipment) revenue in this level. Its revenue growth rate has far exceeded the shipment volume. The system revenue has increased by 35% year-on-year, while the shipment volume has only increased by 1%.

△ Global industrial system shipments by material (polymer, metal, other). Comparison between the third quarter of 2021 and the third quarter of 2022

Professional equipment

In the professional price category, the shipment volume decreased by – 7% compared with the third quarter of 2021. The shipment volume of FDM/FFF printers decreased by – 8%, and that of SLA printers decreased by 21% compared with a year ago. The shipment volume of FDM was relatively stable in the third quarter, which was only – 1% lower than that of the same period in 2021, but the shipment volume of SLA was different, which was – 19% lower than that of 2021. Ultimaker (newly merged MakerBot and Ultimaker) produces both professional and personal printers, with a market share of 36% at this price level, but in general, the shipment volume at this price level has decreased by – 14%. In the third quarter of 2022, UltiMaker and Formlabs (their unit shipments also declined) accounted for 51% of the global professional system revenue. Nexa3D is the new company to join this category in this quarter, and its shipment of Xip printers is increasing.

Personal and spare parts bags and hobby equipment

Since the epidemic of COVID-19, the growth of these low-end markets has slowed down significantly, and the personal and spare parts and amateur fields continue to be dominated by a company called Chuangxiang, the market share leader. During this period, personal shipments fell by – 11%. The shipments of spare parts and hobbies decreased by – 3%, – 10% lower than that in the third quarter of 2020 (at the beginning of the popularity of COVID-19) and remained flat on the basis of 12 months of tracking (up 2%). An important highlight is the emergence of Bambu Lab (Tuozhu), which started shipping in the third quarter of 2022, and successfully raised US $7.1 million on the Kickstarter platform, with 5513 pre-orders of about US $1200 each. Previously, only two 3D printers were better crowdfunding, Anker ($8.9 million) and Snapmaker ($7.8 million).

Post time: Jan-11-2023